SaaS Keyword Research: A Complete Guide

SaaS keyword research is the strategic process of identifying, analyzing, and prioritizing the exact search terms your ideal customers use throughout their buying journey, from learning about a problem to comparing and choosing software solutions.

Unlike traditional SEO, which often chases broad, high-volume keywords, SaaS SEO and SaaS keyword research focus on intent-driven, conversion-oriented phrases that connect directly to product trials, demos, and revenue outcomes. High-intent commercial keywords convert 2.3× better than informational ones for SaaS trials and demo requests.

Key Takeaways

- SaaS keyword research guides content that attracts qualified leads and supports revenue goals.

- Map terms to site pages so blogs, product pages, and assets work together.

- Focus on intent, SERP features, and conversion ability, volume alone won’t win.

- Include category, comparison, and alternatives topics to reach later-stage buyers.

- Prioritize words by business impact to avoid vanity metrics and cannibalization.

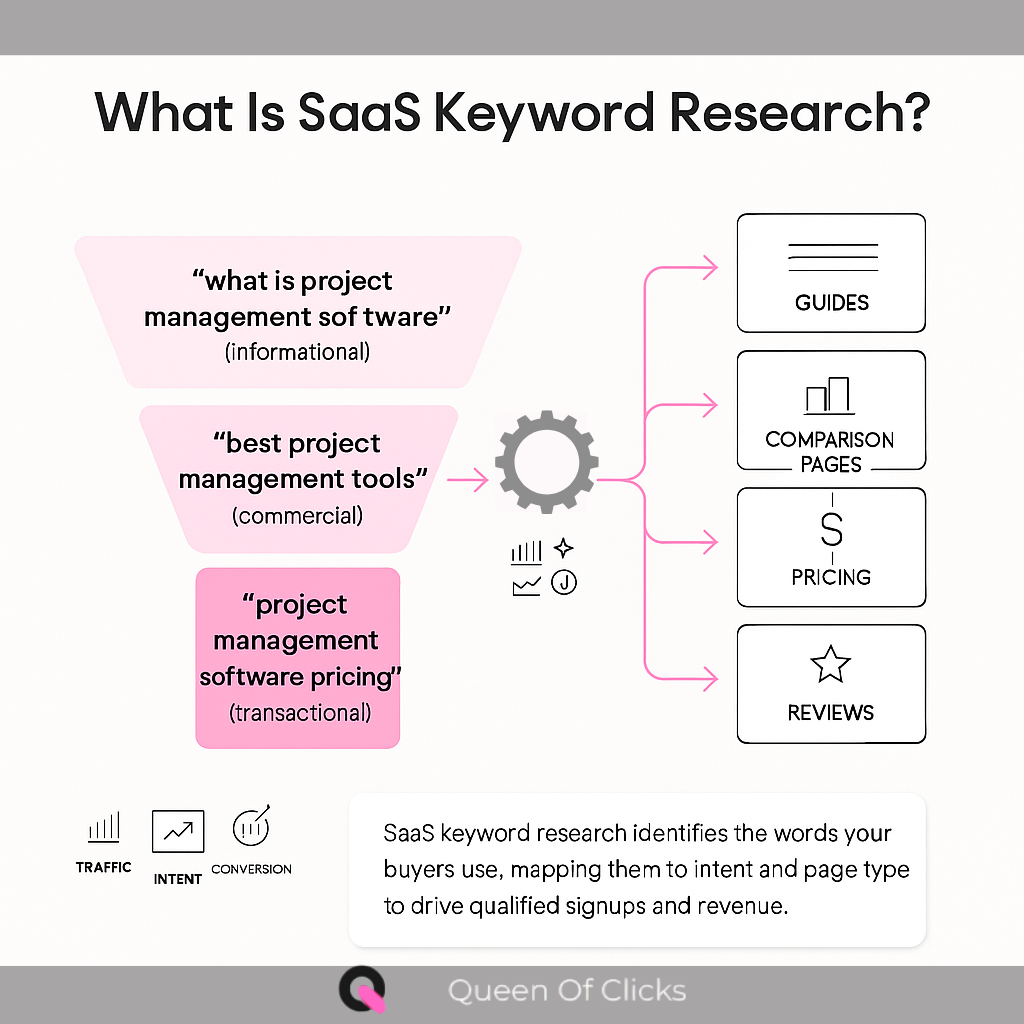

What Is SaaS Keyword Research

Good search strategy begins with knowing the exact words your buyers use when they look for solutions. At its core, saas keyword research is the ongoing practice of identifying those words and building a plan to win visibility and conversions.

This work spans branded, commercial, and informational terms. For example, a brand should own product-focused pages (like “Mailchimp features”), comparison pages (“best email automation tools”), and basic explainers (“what is email automation”).

Search volume is a directional signal, not the sole decision-maker. Low-volume commercial terms can drive more trials than high-volume generic ones. You map each keyword to intent and to page types, guides, solution pages, comparisons, pricing, and reviews.

Scope And What You’ll Operate

- Ongoing discovery and expansion using tools plus sales and product inputs.

- Content planning, technical fixes, and measurement tied to business impact.

- Scoring, mapping to pages, and avoiding cannibalization across your website.

Why Is SaaS Keyword Research Important

Google’s generative answers and richer SERP features now take prime space for broad questions. That change compresses traditional top-of-funnel opportunity and forces a more tactical approach.

How Evolving SERPs And SGE Change Your ToFu Strategy

SGE and rich results often answer generic queries without a click. You must evaluate whether a topic will drive real visits or only impressions.

Shift effort to mid- and bottom-funnel phrases that signal commercial intent. Examples like “project management software for marketing agencies” show clear buyer interest and higher conversion potential.

Tying Keywords To Revenue, Not Just Traffic

Map terms to pages that prompt action: trials, demos, pricing, or tailored landing pages. This links search activity to measurable business outcomes.

- Use SERP reads to decide when to pursue or skip a topic based on click potential.

- Prioritize commercial qualifiers and vertical-specific queries that match your audience.

- Set stakeholder expectations around traffic versus pipeline to keep your strategy focused on revenue.

SaaS Keyword Research vs Traditional Keyword Research

While both SaaS and traditional keyword research aim to improve visibility in search engines, their goals, methods, and success metrics differ significantly.

Traditional keyword research typically emphasizes search volume and general visibility, focusing on bringing as much traffic as possible to a site.

SaaS keyword research, however, zeroes in on intent-driven, conversion-focused terms that match the buyer’s journey, from awareness to decision. It’s about quality over quantity: identifying the right topics that drive signups, demos, or subscriptions, not just clicks. This approach demands a deeper understanding of user intent, SERP behavior, and the lifecycle of a SaaS customer.

Here’s a detailed comparison:

| Aspect | SaaS Keyword Research | Traditional Keyword Research |

| Primary Goal | Drive qualified signups, demos, and recurring revenue | Generate broad traffic and brand awareness |

| Focus | Buyer intent, product relevance, and funnel stage alignment | High search volume and keyword difficulty |

| Keyword Types | Commercial, product-aware, comparison, and use-case phrases | Informational, generic, and industry-wide terms |

| Content Mapping | Keywords mapped to specific page types (guides, features, pricing, comparisons) | Keywords mapped mostly to blog posts and category pages |

| Measurement of Success | Trials, demos, MQLs, SQLs, and pipeline influence | Clicks, impressions, and overall organic sessions |

| SERP Analysis | Evaluates click potential, rich results, and SGE impact | Focuses mainly on ranking position and traffic volume |

| Keyword Prioritization | Based on business impact, conversion potential, and domain authority | Based on volume and competition metrics |

| Update Frequency | Ongoing—revisited quarterly as products and SERPs evolve | Periodic—less sensitive to changing intent |

| Research Inputs | Sales calls, customer feedback, G2/Reddit discussions, product data | Keyword tools and trend reports |

| End Outcome | Revenue-focused SEO that aligns marketing and product strategy | Visibility-focused SEO that boosts awareness |

Why Understanding the Audience Is Important, Not Just Keywords

Map how real people describe their problems; this shapes better search outcomes than chasing volume.

Mapping Stages Of Awareness To Search Behavior

Use stages-of-awareness (Unaware → Problem Aware → Solution Aware → Product Aware → Most Aware) to predict how searches change. Early queries use problem language. Later searches include product names, pricing, and comparisons.

Map the questions customers ask at each stage and turn those phrases into practical keywords that match intent and page type.

Buyer’s Journey vs. Funnel: Choosing The Lens That Guides Your Content

The traditional funnel can feel neat but often misses messy human behavior. Awareness stages mirror how people actually learn and decide.

- Extract real language from sales calls, support tickets, and customer success notes.

- Prioritize product-aware and most-aware searches that point to trial, demo, or pricing pages.

- Create content that differentiates your product and answers specific customer questions at each stage.

When you plan from the audience outward, you avoid wasted effort on topics that never become pipeline and build a stronger, intent-driven strategy.

Understanding Search Intent For SaaS

When users type a query, their intent dictates the page they need, not the other way around. Learn to read SERPs and modifiers like “best,” “vs,” “pricing,” and “how to” to spot intent fast.

Four core intents map directly to page design and CTAs. Informational queries need clear guides and FAQs. Navigational searches want sign-in or brand pages. Commercial queries call for comparisons and alternatives. Transactional searches require pricing and checkout-ready pages.

Matching intent to page types and CTAs

- Use guides and FAQ hubs for informational intent, with CTAs to related solution pages.

- Create comparison hubs and alternatives for commercial intent, with CTAs to demos.

- Offer pricing and trial CTAs for transactional intent to shorten the path to action.

- Adapt internal linking and headings so each page satisfies the user’s journey step.

| Intent | Example Query | Page Type | Primary CTA |

| Informational | what is project management | Guide / FAQ | Read related solution page |

| Navigational | asana login | Brand / Login | Sign in |

| Commercial | best project management tools | Comparison hub | View demos |

| Transactional | asana pricing | Pricing / Product | Start free trial |

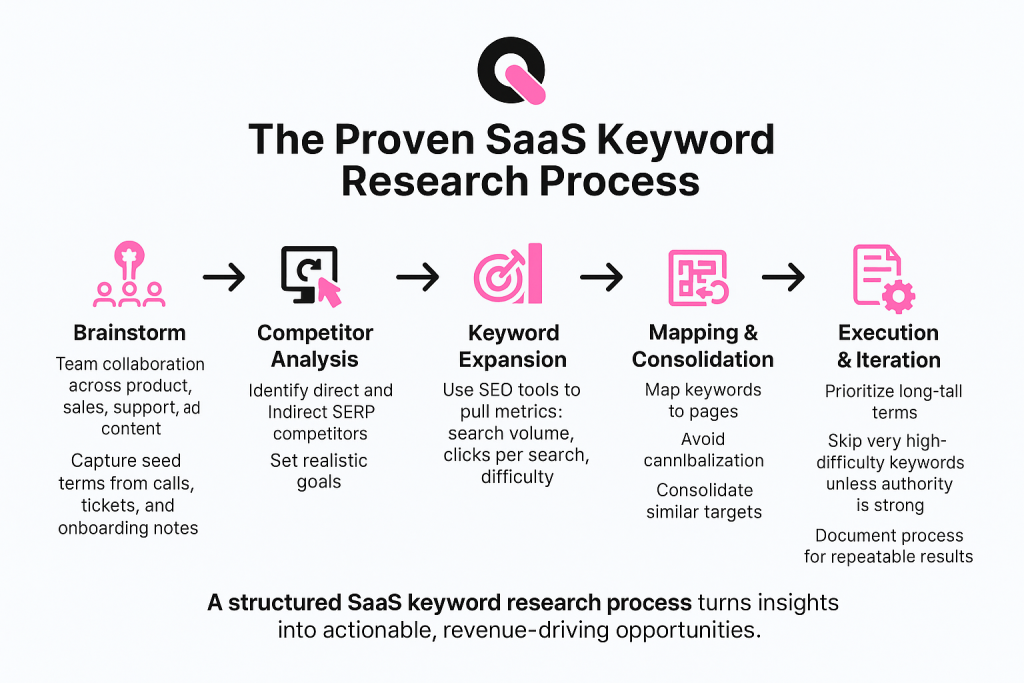

What Is the Proven SaaS Keyword Research Process

Build a repeatable process that turns team knowledge into measurable search opportunities. Bring product, sales, support, and content together for a short brainstorming session. Capture seed terms from calls, tickets, and onboarding notes so your list reflects real user language.

Core steps

- Identify direct and indirect competitors on the SERP to set realistic goals.

- Use tools to expand seeds and pull metrics like search volume, clicks per search, and difficulty.

- Assign intent, then score each term by search feasibility and business priority.

- Map terms to existing or new pages and avoid cannibalization, and consolidate similar targets.

Prefer long-tail terms early, and skip very high-difficulty targets unless your domain authority is strong. Document the process so your team can repeat it and update pages based on performance data over time.

What Are the Methods That Uncover High-Intent SaaS Keywords

Focus on what users want to accomplish and you’ll find the phrases that drive trials and demos. Practical methods combine customer work and public signals so you surface real buying language, not guesses.

Jobs-To-Be-Done and ICP vs. Anti-ICP

Use Jobs‑to‑be‑Done to segment searches by use case. Map which jobs your product solves and which it does not.

Define your ICP and explicitly list Anti‑ICP traits to avoid traffic that looks relevant but never converts.

Sales Call Mining and Customer Interviews

Record and tag calls for recurring phrases. Long‑tail expressions from demos and objections turn into precise content targets your competitors miss.

Reddit, Review Sites, and Google Autosuggest

Mine Reddit threads for pain points and exact questions people ask before they buy. Pull features and comparison language from G2 and Capterra to shape product and alternatives pages.

Use Google Autosuggest to expand modifiers and FAQ items that reflect real search behavior.

- Clarify ICP vs Anti‑ICP so your plan attracts buyers who convert and retain.

- Apply Jobs‑to‑be‑Done to reveal use cases that map to ready‑to‑buy searches.

- Turn sales language into long‑tail targets and FAQ copy.

- Extract recurring pain points from reviews and forums for later‑stage topics.

Commercial And BoFu Keywords That Convert

When buyers are one click from a decision, well-structured comparison and pricing pages close the loop. Build BoFu (Bottom of the Funnel) assets that answer last‑mile questions and push visitors toward a trial or demo.

Category Keywords: “Best [Software Type]”

Create content that ranks for “best” lists and early shortlist queries. These pages influence first impressions and get your product onto shortlists early.

Alternatives And Comparisons To Influence Final Decisions

Fair, data‑backed comparison pages win hesitant buyers who liked a competitor but need a better fit on price, features, or usability.

Compare use cases, costs, and support clearly. Link comparisons to demos and trials so intent converts into action.

Pricing, Reviews, And Feature Pages For Product-Aware Users

Pricing pages, reviews, and social proof reassure product‑aware users and lift trial‑to‑paid rates. Use concise feature pages for sub‑category searches that show exactly what your product does.

- Prioritize “best” lists, alternatives, comparisons, pricing, and reviews in your cadence.

- Structure comparisons with outcome‑focused tables and impartial scoring.

- Use internal links from BoFu pages to demos, trials, and sales flows to maximize conversions.

- Remember: lower search volume often equals higher business impact when intent is clear.

Prioritization: Balancing Volume, Difficulty, And Business Impact

A smart roadmap balances how hard a term is to win with the business value it can unlock. Use simple, repeatable criteria so your team makes consistent choices over time.

Why KD Is Only A Starting Point

KD or difficulty scores flag possible obstacles, but they miss context. Look beyond the number to page backlinks, domain authority, and how complete competing content is.

Manually review top pages. If rivals lack depth or fresh examples, you may win with fewer links than a raw KD suggests.

Evergreen Potential, Click Potential, And Link Requirements

Prioritize terms with steady or rising interest and clear commercial intent. High search volume is fine, but qualified demand matters more.

- Assess click potential by inspecting SERP features, are there rich results that steal clicks?

- Estimate how many relevant backlinks you need to outrank current pages.

- Score topics by intent, competition, links required, and projected conversions.

| Criteria | What to check | Decision guide |

| Intent | Commercial vs informational | Favor commercial that converts |

| Competition | Backlinks, topical depth | Pick targets within your reach |

| Timing | Evergreen vs fading trends | Prioritize compounding topics |

Document a prioritization score and sequence work: quick wins first, harder topics with link plans later. This keeps your content program tied to real business results.

Advanced Tactics: Clusters, Snippets, And Voice

Design topic clusters around clear user intent so your site reads as a complete, authoritative solution. Anchor each cluster with a pillar page that covers the core problem and links to focused subpages that answer specific questions or use cases.

Intent-Driven Topic Clusters And Topical Authority

Group pages by outcome and buyer stage to reduce cannibalization and improve internal linking. Combine product-aware pages with MoFu content so readers move from explanation to demo-ready pages.

Featured Snippet Optimization And SERP Feature Targeting

Structure concise answers, numbered steps, and comparison tables to win snippets and increase CTR.

- Use short lead answers (40–60 words) then expand below.

- Add schema for FAQs and how-tos to qualify for rich results.

- Refresh content on a cadence to retain snippet ownership.

| Format | Best Use | Why It Wins |

| Paragraph | Direct definitions | Answers quick queries in SERP |

| List | Steps or features | Scannable, high CTR |

| Table | Comparisons | Surface data clearly for snippets |

Voice Search And Conversational Queries

Prepare for voice and use natural-language questions and short answers. Track performance to measure snippet and voice gains and update pages as product details or search volume shift.

How to Turn Data Into Direction: GSC, PPC, And Competitive Gaps

Don’t guess, let data from your site and ads point to the next pages you should build. Use signals from Search Console, paid campaigns, and competitor audits to create a prioritized plan that maps directly to business intent and conversions.

Mining Google Search Console With RegEx For New Topics

Run RegEx groupings such as ^what|^when|^why|^who|^how|^where|^do|^are to spot question patterns and ^Best$|^Alternative$|^Vs$ for commercial modifiers. Add a position filter of 50+ to surface untapped queries. Export beyond the 1,000-row cap via Looker Studio to capture the full long tail.

Leverage PPC Conversion Data To Validate Keyword Value

Cross-check paid search reports to see which queries drive signups. Prioritize those topics in organic plans and mirror winning ad copy on new pages to improve conversions and reduce time-to-value.

Content Gap Analysis To Find Opportunity

Compare your website to competitors to reveal pages they rank for that you don’t. Turn each gap into a page plan with intent, CTAs, and internal links so content converts faster.

- Mine GSC with RegEx to reveal question and commercial patterns.

- Focus on position 50+ hits and export via Looker Studio for the long tail.

- Use PPC conversions to validate and prioritize topics for organic pages.

- Run competitor gap analysis and map findings to page plans and reporting.

| Source | Use | Outcome |

| GSC | RegEx groups + pos filter | New topic list |

| PPC | Conversion queries | Validated targets |

| Gap Analysis | Competitor pages | Page plan & CTAs |

How to Build the Right Pages: From Features To Use Cases

Design pages that mirror real user tasks to turn discovery into evaluation, and finally, action.

Create feature subpages for specific capabilities (for example, demand planning software or inventory optimization software). These pages should show exactly how your product solves a job, with short examples and feature callouts that speak to product-aware users.

Feature And Solution Pages For Product-Aware Searches

Structure each feature page with a clear headline, concise benefit statements, and a short FAQ that matches the user’s intent. Use meta titles and headers that include target terms and the product name so search engines and buyers see relevance immediately.

Adjacent And Switch-Moment Use Cases

Capture switch moments and publish migration content like “Excel to inventory software” or “Jira to Asana alternatives.” These pages help users comparing platforms find your product when they are ready to move.

- Build vertical solution pages that map to industry use cases and customer journeys.

- Add comparison and migration pages that highlight cost, time savings, and ease of switch.

- Link features, comparisons, and trials together to form a cluster that strengthens topical authority.

- Include social proof, short demo clips, and contextual CTAs so users can act quickly.

| Page Type | Primary Intent | Primary CTA |

| Feature subpage | Product-aware | View demo |

| Migration guide | Comparison/switch | Start trial |

| Vertical solution | Use-case discovery | Contact sales |

Finally, review analytics regularly to refine which features you highlight, adjust CTAs, and improve on-page copy. Iteration ensures your website keeps attracting qualified users and supports sales outcomes.

What Are the Common SaaS Keyword Research Pitfalls To Avoid

Teams often publish obvious topics and hope traffic turns into trials, most of the time it doesn’t. Without a plan, you’ll end up with lots of ToFu pages that earn impressions but not pipeline.

Stop the spray-and-pray approach. Decide which searches you want to own and map each target to a page type and CTA.

Spray-And-Pray Content And ToFu Overload

Too many broad posts mean you compete with big publishers and SGE for clicks. Focus on mid- and bottom-funnel terms that signal buyer intent.

Ignoring Intent, Cannibalization, And Misaligned CTAs

Multiple pages targeting the same term dilute rank and confuse users. Align CTAs so informational pieces guide to related demos and commercial pages push trials.

- Avoid volume-only publishes: they rarely translate into pipeline.

- Fix cannibalization: consolidate or differentiate overlapping pages.

- Match CTA to intent: don’t hard-sell on purely informational assets.

- Read the SERP: mirror winning formats and depth before you write.

- Governance & audits: map clusters, run periodic audits, and reassign targets.

| Common Mistake | How to Spot It | Quick Fix |

| Over-indexing on ToFu | High impressions, low clicks/conversions | Shift effort to commercial topics |

| Cannibalized pages | Several pages rank for same terms | Merge or clarify intent per page |

| Wrong CTA | Info page with trial CTA that confuses readers | Use gentle CTAs leading to demos or guides |

🚀 Partner With Queen of Clicks: Your Dedicated SaaS SEO Agency

Your audience-first plan starts here. Queen of Clicks aligns content and pages to buyer stages so your website turns search interest into trials and sales.

Why work with a specialist

- Audience-first planning: Keywords to awareness stages and the buyer’s journey so pages meet real demand.

- BoFu acceleration: Alternatives, comparisons, pricing, and feature assets that convert product-aware visitors.

- Data-driven roadmaps: GSC mining, and gap analysis to prioritize topics by business value.

- Technical and on-page excellence: Structure pages for snippets, SERP features, and internal linking to build topical authority.

- Sustainable growth: Intent-driven clusters that compound, improving CTRs and assisted conversions over time.

Visit And Next Steps

- Fill in the contact form

- Request a SaaS SEO audit and roadmap

- Kick off a prioritized content and page build plan with clear timelines and milestone reviews

| Focus | What You Get | Result |

| Audience Strategy | Target audience mapping | Better-qualified traffic |

| Content & Pages | BoFu assets + feature pages | Higher conversions |

| Data & Optimization | GSC, gap analysis | Prioritized roadmap tied to business results |

Conversion Focus: Every recommended asset includes page type, CTA, and internal links to move qualified visitors toward demos, trials, or sales conversations.

Conclusion

The payoff comes when your content program links intent to revenue and protects gains with regular updates.

Use semantic mapping and intent alignment so each page answers a real need. Prioritize commercial value over vanity metrics and build clusters that establish topical authority.

Turn data into direction: mine GSC and PPC, find competitive gaps, and refresh pages to keep snippets and voice answers. Build the right mix of pages, features, solutions, comparisons, alternatives, pricing, and reviews, to match how your audience actually buys.

Treat KD as a starting point, keep listening to people via calls and reviews, and measure success by qualified pipeline and revenue. Commit to steady execution and iteration so your keyword and research work compounds into business outcomes over time.

FAQs

What makes SaaS keyword research different from traditional SEO keyword research?

SaaS keyword research focuses on understanding the buyer journey, from problem awareness to product comparisons, and aligning keywords to stages that drive trials or demos. Unlike traditional SEO, which often targets broad or informational terms, SaaS SEO prioritizes commercial and product-aware queries that lead directly to revenue.

How often should I update my SaaS keyword research?

At least quarterly. Search intent, SERP features, and competitors evolve quickly in SaaS. Reviewing your keyword list every few months ensures you capture new demand, refresh outdated pages, and stay visible for emerging product-related searches.

What tools are best for SaaS keyword research?

Tools like Ahrefs, Semrush, and Google Search Console are foundational. Pair them with G2, Reddit, and customer call transcripts to uncover authentic buying language. SaaS marketers often combine multiple tools to balance data accuracy with real-world user insights.

Should SaaS companies target low-volume keywords?

Yes, especially if they show clear buying intent. Low-volume, high-intent terms such as “CRM for real estate teams” or “best project tracking app for agencies” often convert better than high-volume, generic phrases.

How do SaaS companies use competitors for keyword discovery?

Analyze competitor landing pages, blog posts, and comparison articles to identify gaps in your own strategy. Use tools like Ahrefs’ “Content Gap” or Semrush’s “Keyword Gap” to find terms your competitors rank for, but you don’t.